The total national (federal) debt of the United States is the sum of accumulated borrowings and interest of the US Federal Government throughout the history of the state.

Any country has the ability to borrow by issuing government bonds, but it can also borrow in tranches. For example, in the 1990s, Russia received assistance from the IMF in this way.

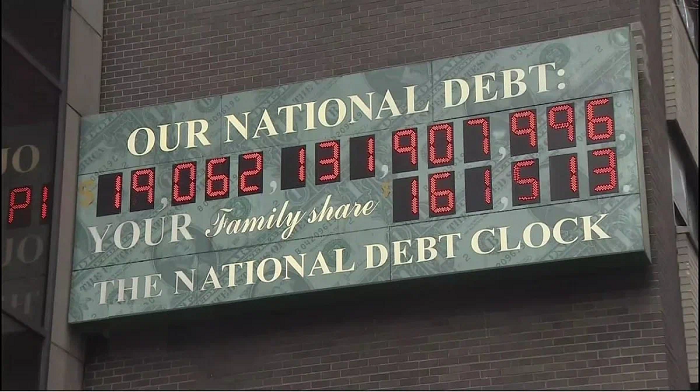

132.4% of GDP is a record high reached by US Federal Government debt in March 2021. This is more than it was after the Second World War. As of February 2023, this figure was 123.6% of GDP, which corresponds to $31.4 trillion with a nominal GDP of $25.46 trillion. Is it a lot?

The United States has the largest GDP in the world, but at the same time it is not the most leveraged economy among developed countries. And there are more and more states that have a debt level of more than 100% of GDP. And it remains to be seen whether developing countries will follow the path of the United States in terms of increasing their debt burden when economic growth begins to slow down, and no one is immune from the emergence of such global threats as wars and epidemics.

Why is it customary to compare public debt with GDP? First, it is a convenient indicator for contextual comparisons. Secondly, GDP shows the size of the economy, its efficiency, because represents the market value of all goods and services produced within a country over a given period of time, such as a year.

GDP can be calculated in three ways: income, expenditure and value added created in the production process. Just the first option gives us the answer. The higher the income, the easier it is to pay off the debt.

When debts begin to exceed revenues, serious problems arise with the financing of the main budget items. It is necessary to repay not only the debt itself, but also the interest that grows like a snowball. Therefore, the ratio of debt to GDP is often considered as the number of annual GDP required to pay off the entire debt. In our case, the US will need more than a year of work of the entire country just to fully pay off. The question is, why did the state start borrowing such huge amounts of money, and who provides them?